Public Policy

2024 Public Policy Tri-chairs:

Liz Morse

Richardson ISD

John Hurst

Lennox

Mark Solomon

Assurnet Insurance Agency

The Public Policy committee exists to provide information and advocacy regarding local, state and federal policy decisions and how they impact chamber members and our city.

Public Policy hosts educational and informative briefings for members about legislative issues, fosters relationships with elected officials and coordinates events to inform our members on issues that affect Richardson. These events include:

- Public Policy briefings

- Candidate Forums

- Austin Legislative Tour

- Federal Legislative Tour

- Voter Registration events (See Voter Resources here)

During Texas legislative years, the committee develops a legislative agenda and advocates on behalf of those priorities.

Check this page and our calendar for all upcoming events.

To stay up-to-date with Public Policy, sign up for our mailing list. Select Public Policy from the topic selections and you'll never miss our legislative updates and event and tour announcements.

Serving on a committee is one of your strongest relationship building tools, working side-by-side with other business leaders. Chamber members can join the Public Policy committee, which develops the Richardson Chamber's legislative agenda and plans the events and activities of the committee. Your involvement makes a difference!

Committee meetings are held on an as-needed basis. If you're interested in joining, fill out the volunteer form.

Sponsorship: If you're interested in sponsoring Public Policy or our legislative tours, see our Sponsorship Packet and contact us with any questions.

Richardson Chamber of Commerce 2023 Legislative Agenda

Click here to see a recap of how well the Texas 88th Legislature did regarding our priorities.

Upcoming Events

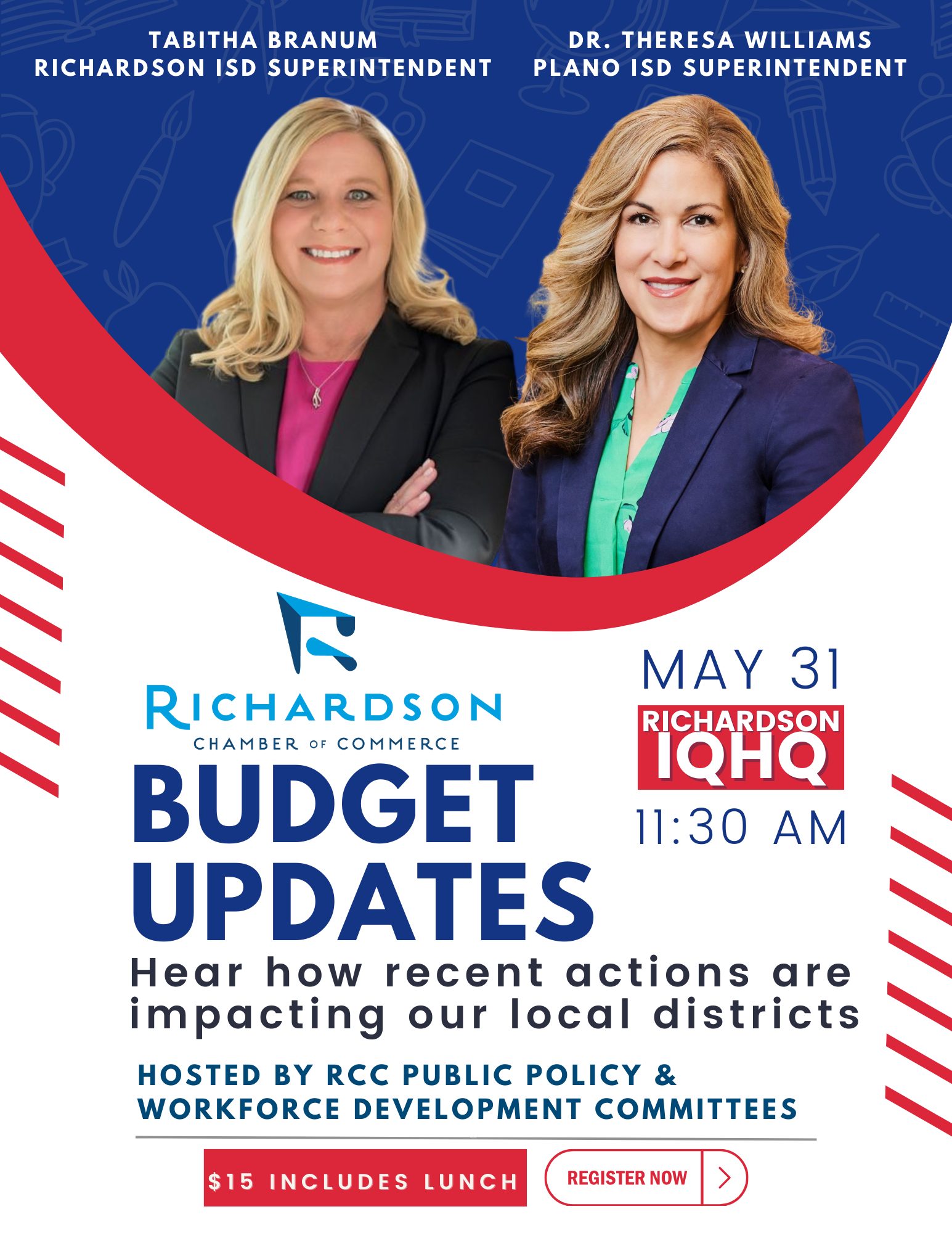

Friday, May 31 at 11:30 am

BUDGET UPDATES

Speakers:

Tabitha Branum, RISD Superintendent

Dr. Theresa Williams, PISD Superintendent

Previous 2024 Events

February 16, 2024

Candidate Forum for Texas Senate District 16, featuring Nathan Johnson, State Senator, District 16, and Victoria Neave Criado, State Representative, District 107

March 25, 2024

Inside Texas Politics, featuring Jason Whitely, WFAA Political Reporter